Tax Payment Via Credit Card. Deferment of Tax Instalment Payments for Small and Medium Enterprises and Special Revision of Income Tax Estimation.

Here S A Guide On How To File Your Income Taxes In Malaysia 2022 Soyacincau

Taxpayers can make payments of income tax and real property gains tax using a credit card online at httpsbyrhasilhasilgovmycreditcard.

. Ibu Pejabat Lembaga Hasil Dalam Negeri Malaysia Menara Hasil Persiaran Rimba Permai Cyber 8. However credit card charges of 080 will be imposed on your income tax payment. All companies required to pay their monthly instalment by the 15th day of each month.

As highlighted in earlier alerts a number of tax and non-tax measures have been announced as Malaysias response to the COVID-19 pandemic including the following. Businesses in the tourism sector and Small and Medium Enterprises. AmendFix Return Form 2848.

IRBM Payment Counters at Kuala Lumpur Kota Kinabalu and Kuching can accept tax payment using credit and debit card. Monthly Tax Deduction MTD 6. Perkhidmatan ini boleh digunakan untuk semua kad kreditdebit VISA Mastercard dan American Express yang dikeluarkan di Malaysia.

E Payment via Cheque Deposit Machine CDM You can also make your individual Income Tax and RPGT payment using a CDM at Public Bank Berhad. Example Number of months in basis period 12 months Estimated tax payable RM12000 Therefore monthly installment RM12000 RM1200012 months RM1000. Balance of Tax Payment.

Income Tax Payment excluding instalment scheme 7. 25 rows Tax Instalment Payment Individual. Further to the announcement in the 2022 Budget on 29 October 2021 the Malaysian Inland Revenue Board has issued the following.

F Payment via Cash Deposit Machine CAM. An increase of 10 on that installment. Investigation Composite Instalment Payment.

INSTALLMENT PAYMENT BY INDIVIDUAL OTHER THAN EMPLOYMENT CP500 6 installments will be issued by LHDNM Payment beginning March Installment must be aid within 30 days Of estimated tax before 30 June EMPLOYMENT MTD Tax deduction based on MTD Method Pay before on the 15th of every month CP39 PAYMENT AND FORM FORMS APPOINTED LHDNM. For new companies installment for tax payments must commence in the 6th month of the basis period for the year of assessment ie. Real Property Gain Tax Payment RPGT 5.

File Form 843 to request an abatement of taxes interest penalties fees and additions to tax. RM12000 12 RM100000. For the BE form resident individuals who do not carry on business the deadline for filing income tax in Malaysia is 30 April 2020.

Bayaran Cukai Pendapatan melalui Kad Kredit boleh dilakukan di portal ByrHASIL dari 1200 am hingga 1059 pm setiap hari. The assessment shall be made between CP500 instalment and tax payable. For new companies instalment payments will commence in the 6th month of the basis period for the year of assessment ie.

Payable in the 6th month after the company commences operations. Perkhidmatan akan ditutup dari 1100 pm hingga 1159 pm setiap hari bagi tujuan penyenggaraan. Payable in the 6th month after the company commences operations.

Tax Payment via Credit Card through ByrHASIL portal will only be available from 1200 am until. If the taxpayer wishes to pay tax via Telegraphic Transfer TT Interbank GIRO Transfer IBG or Electronic Fund Transfer EFT they will have to call the HASIL Care Line to receive the payment procedure at 03-8911 1000 call within Malaysia or 603-8911 1100 call from oversea. The type of tax payments that can be paid using credit and debit cards at.

Tax Payment Using Credit and Debit Card at IRBM Payment Counters. Alternatively they can also drop an email at email protected. Income tax payment can be made by credit card Issued by Malaysia bank in Malaysia.

A company is required to pay the installment of the estimated tax by the 10th day of each month. November 30 2021 The Malaysian Inland Revenue Boardfollowing announcements in the 2022 budgetissued the following guidance for small and medium-sized enterprises SMEs. Tax Instalment Payment Company.

These services can be used for all creditdebit cards VISA Mastercard and American Express issued in Malaysia. Installment installment 122995 USD. Penalty Payment For Section 103A 103.

All VISA Mastercard American Expresscredit cards and debit cards issued in Malaysia can be used for tax payment. However credit card charges of 080 will be imposed on your income tax payment. User is required an internet banking account with the FPX associate.

Manual submission of ITRF is by 30thJune e-Filing submission of ITRF is by 15thJuly Monthly instalment. Headquarters of Inland Revenue Board Of Malaysia. In response to the extension of certain tax-related measures to continue supporting businesses affected by COVID-19 announced in the 2022 national budget the Malaysian Inland Revenue Board IRB recently issued a media release dated 29 November 2021 and a set of.

Frequently asked questions FAQs concerning the deferment of tax instalment payments for six monthsfrom 1 January 2022 to 30 June 2022for SMEs. A Frequently Asked Questions FAQs in respect of the deferment of tax instalment payments for 6 months from 1 January. Installment tax is a form of advance tax administered under the Income Tax Act Cap 470 laws of Kenya.

IRBs FAQs on revision of estimate of tax payable and deferment of tax instalment payments arising from COVID-19 measures. Payment of individual Income Tax and RPGT can be made via tele-banking service only at Maybank Berhad Kawanku Phone Banking 1-300-88-6688. Income tax payment can be made by credit card Issued by Malaysia bank in Malaysia.

Your income tax payment can be made with Ezypay of 6 months 125 interest or 12 months 205 interest if your income tax amount is between RM1000 to RM500000 and you are. SAS - Payment By Installment The estimated tax payable has to be paid in equal monthly installments beginning from the second month of the basis period for a year of assessment. If the instalment amount CP500 is insufficient the amount difference must be made to IRBM not later than the year following year of assessment such below.

Additional relief available regarding tax estimates MSMEs installment payments in Malaysia.

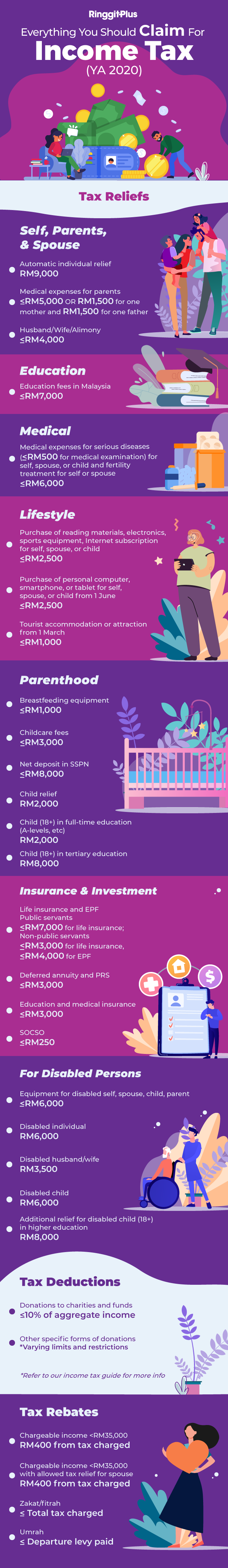

Malaysia Tax Relief Stimulus Measures For Individuals Kpmg Global

Sisense Bi Online Training Rpa Devops Workday Hyperion Oracle Apps Training In 2022 Online Training Interview Questions Learning Environments

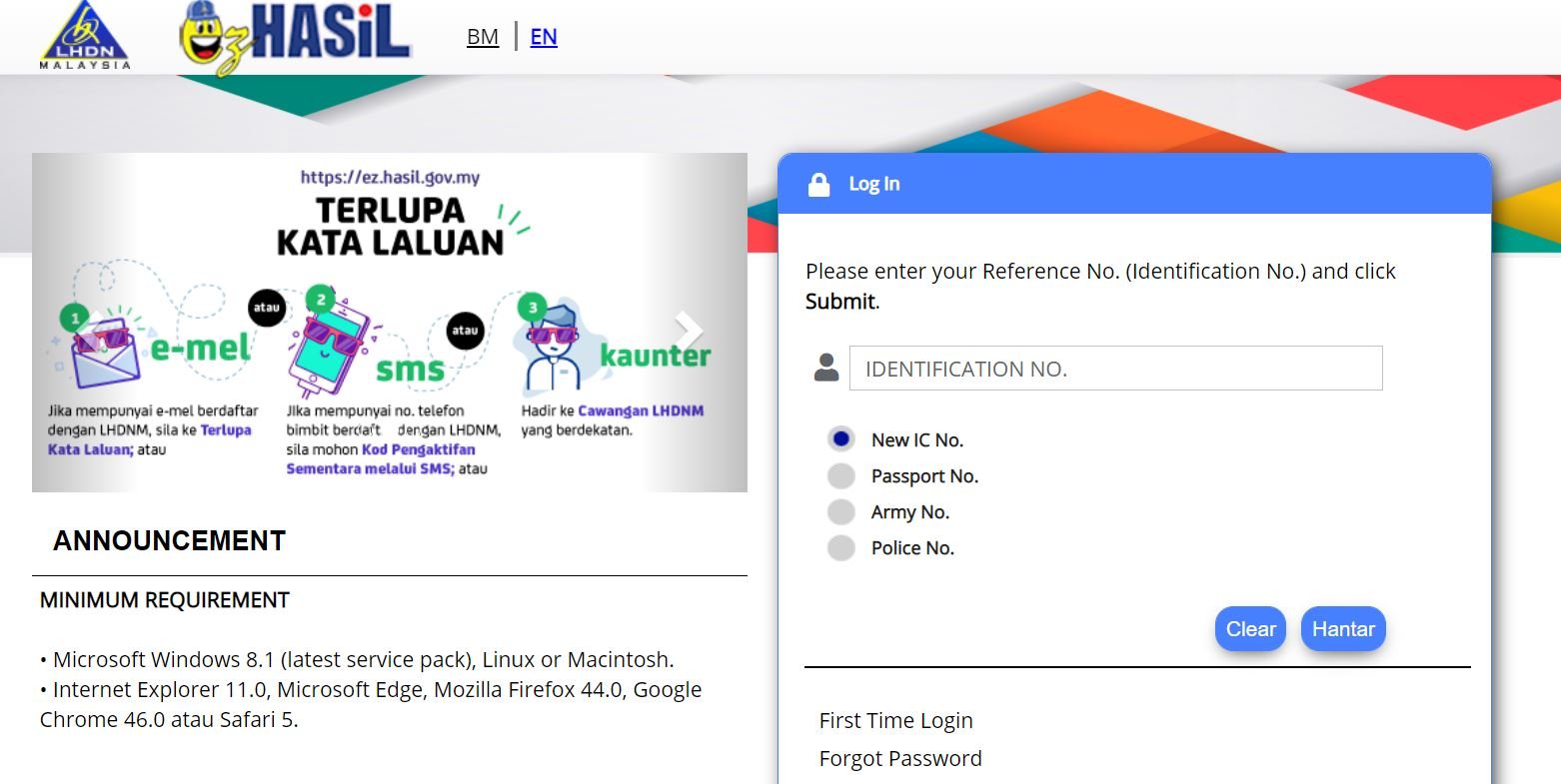

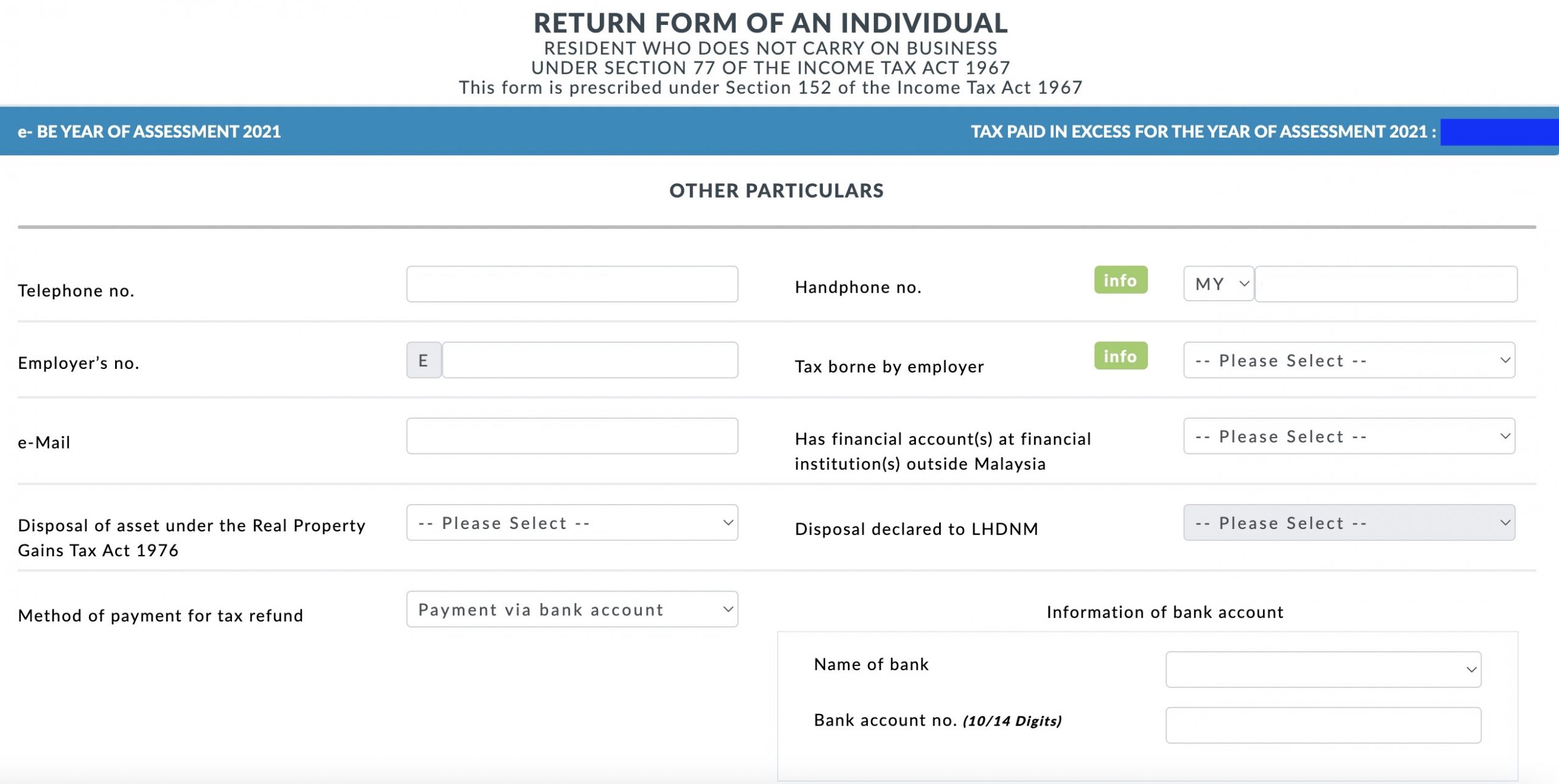

Here S A Guide On How To File Your Income Taxes In Malaysia 2022 Soyacincau

Malaysia Taxation Junior Diary 6 Installment Payment Cp 207

Malaysia Personal Income Tax Guide 2021 Ya 2020

Taxplanning Tax Measures Announced During The Mco The Edge Markets

Malaysia Personal Income Tax Guide 2021 Ya 2020

Here S An Amazing Rate Kuala Lampur Malaysia At Lkr 8 100 0 Installment Plans For Students And Accompanying Parents Student Travel How To Apply How To Plan

Taxplanning Tax Measures Announced During The Mco The Edge Markets

How To Pay Your Income Tax In Malaysia

Taxplanning Tax Measures Announced During The Mco The Edge Markets

Tax On Rental Income 5 Rules You Must Know If You Rent Out Property In Malaysia

Eft Nedir Nasil Yapilir Blog Seyahat Para

Advance Payment Invoice Template 9 Free Docs Xlsx Pdf Invoice Template Invoice Format Microsoft Word Invoice Template

Explore Kl On Your Graduation Lkr 24 500 P P Onwards Call 117773300 Travel Explore Kualalumpur Malaysia Student Travel Kuala Lumpur Airport Transfers

Here S A Guide On How To File Your Income Taxes In Malaysia 2022 Soyacincau

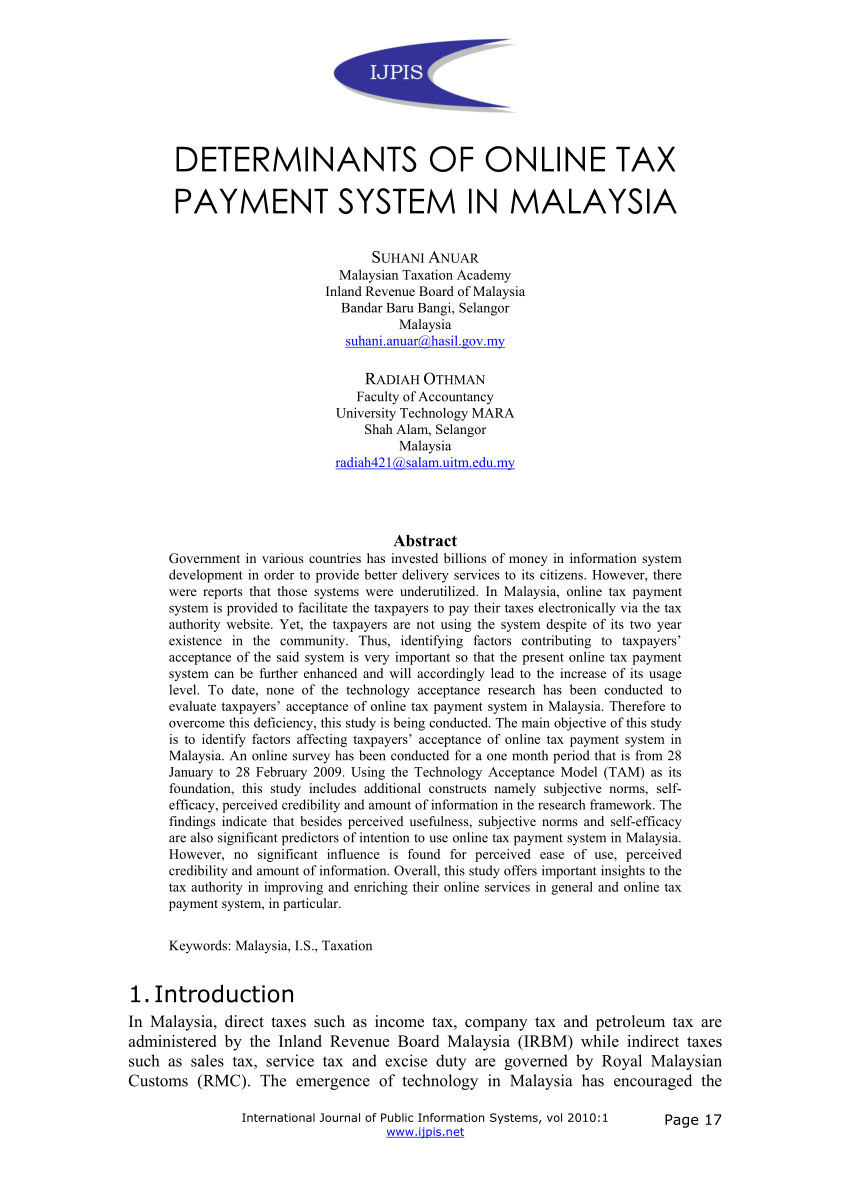

Pdf Determinants Of Online Tax Payment System In Malaysia

Mortgage Refinance Malaysia Instant Loans Mortgage Loans Cash Advance Loans

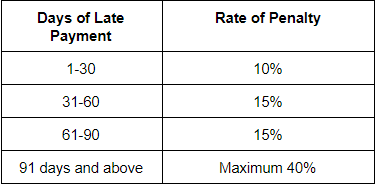

Malaysia Tax Penalty For The Late Payment Of Tax